Lowest Real Estate Taxes in Central Pennsylvania 2025

Even if you pay off your house and own it free and clear, you still have to pay real estate taxes forever, so you should know where to find the lowest real estate taxes in Central PA.

If you don’t have to be in a certain location, municipality, or school district, then it might make sense to buy your next home in an area with lower real estate taxes.

Below are the current real estate tax rates (or “millages”) for Cumberland County and Dauphin County, as well as the 5 lowest real estate tax areas in each county.

How to calculate your home’s Real Estate Taxes:

Total Tax/Millage Rate X Home’s Assessed Value = Real Estate Taxes

EXAMPLE: A home in Upper Allen Township that is assessed for $250,000:

0.0190168 X $250,000 = $4,754.20 in total real estate taxes

NOTES REGARDING ASSESSED VALUE:

Your home’s “Assessed Value” is NOT the “Purchase/Sale Price or “Appraised Value”. It is a separate valuation performed by the county every few years (typically every 5-15 years). You can find your home’s “Assessed Value” here…

Dauphin County Tax Assessment Database

Cumberland County Tax Assessment Database

If you realize that your home’s “Assessed Value” is higher than the actual value (puchase price, appraised value, or potential sale price), then you should appeal your home’s “Assessed Value” with the appropriate county to get it lowered, and thereby lowering your real estate taxes as well.

If your “Assessed Value” is less than the actual value (puchase price, appraised value, or potential sale price), then let it be.

Here’s where to go if you need to appeal your home’s assessed value…

Cumberland County Real Estate Tax Assessment Appeal

Dauphin County Real Estate Tax Assessment Appeal

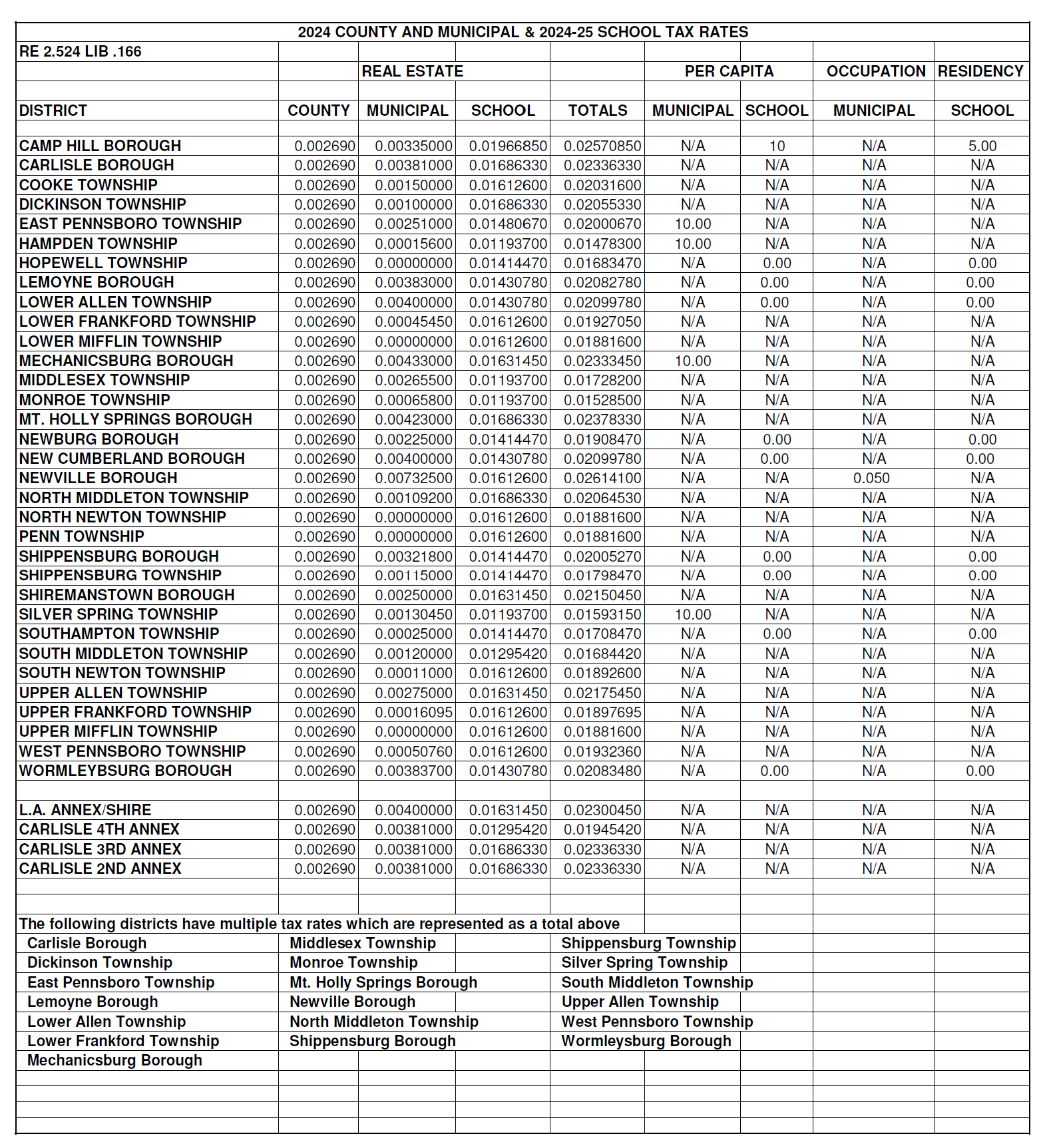

Cumberland County

5 Lowest Real Estate Taxes by Municipality 2025:

- Hampden Township: 0.01478300 (2024: 0.01418300; 2023: 0.01340800)

- Monroe Township: 0.01528500 (2024: 0.01533150; 2023: 0.01455650)

- Silver Spring Township: 0.01593150 (2024: 0.01533150; 2023: 0.01455650)

- Hopewell Township: 0.01683470 (2024: 0.01617200; 2023: 0.01497730)

- South Middleton Township: 0.01684420 (2024: 0.01619220; 2023: 0.01507870)

All Cumberland County Real Estate Tax Rates by Municipality 2025:

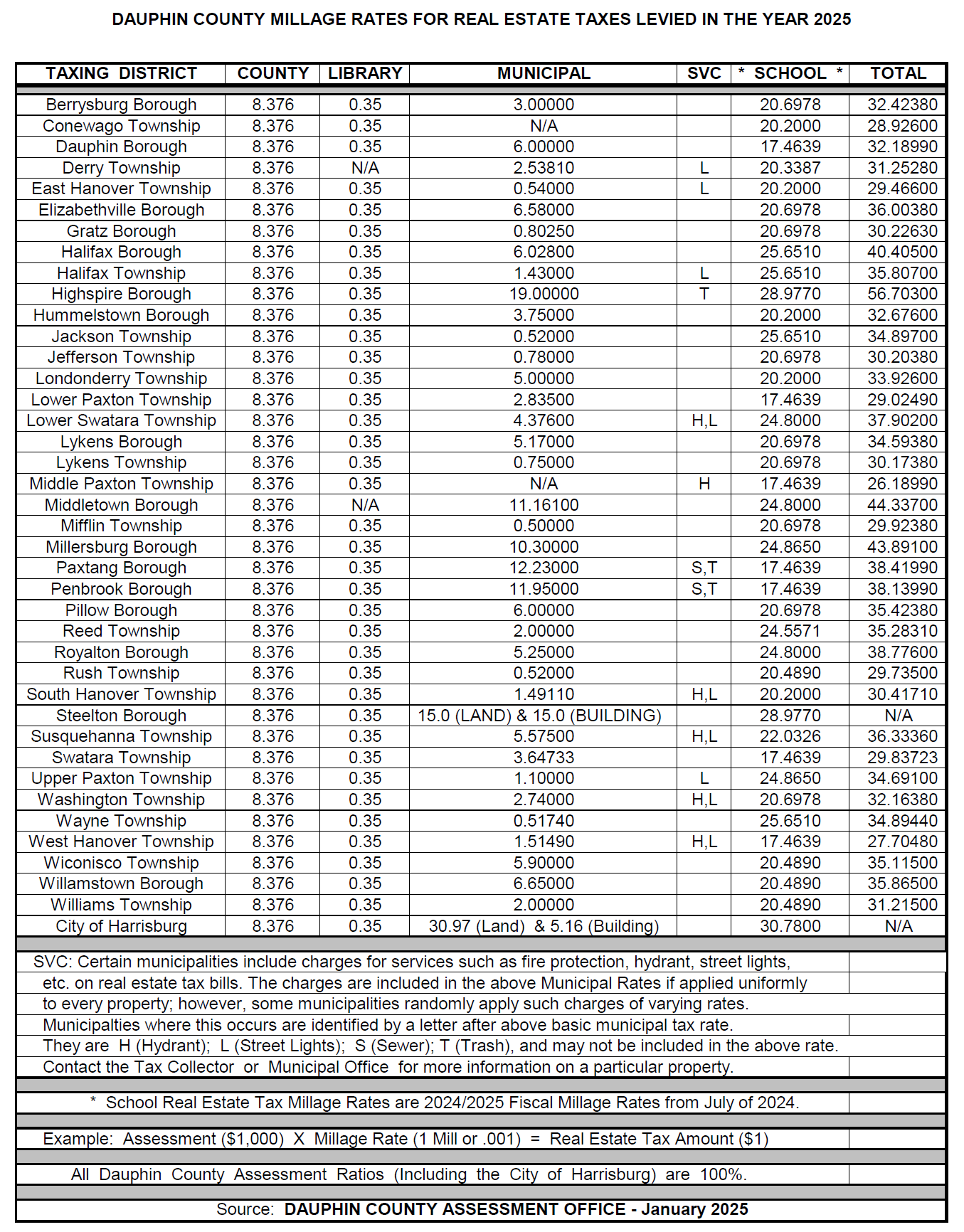

Dauphin County

5 Lowest Real Estate Taxes by Municipality 2025:

- Middle Paxton Township: 0.02618990 (2024: 0.02468990; 2023: 0.02468990)

- West Hanover Township: 0.02770480 (2024: 0.02601530; 2023: 0.02601530)

- Conewago Township: 0.02892600 (2024: 0.02619600; 2023: 0.02619600)

- Lower Paxton Township: 0.02902490 (2024: 0.0269214; 2023: 0.02598440)

- East Hanover Township: 0.02946600 (2024: 0.02655600; 2023: 0.02655600)

All Dauphin County Real Estate Tax Rates by Municipality 2025: